Formidable Tips About How To Settle Old Credit Card Debt

Factor in fees from your debt settlement company (if using one) and federal tax on the forgiven portion of your debt.

How to settle old credit card debt. Your creditor has reported your delinquency to the credit bureaus, and your late payments now appear on your credit report and negatively impact your credit score. Settle the debt by paying less than the full amount. Ad receive personalized loan offers in moments.

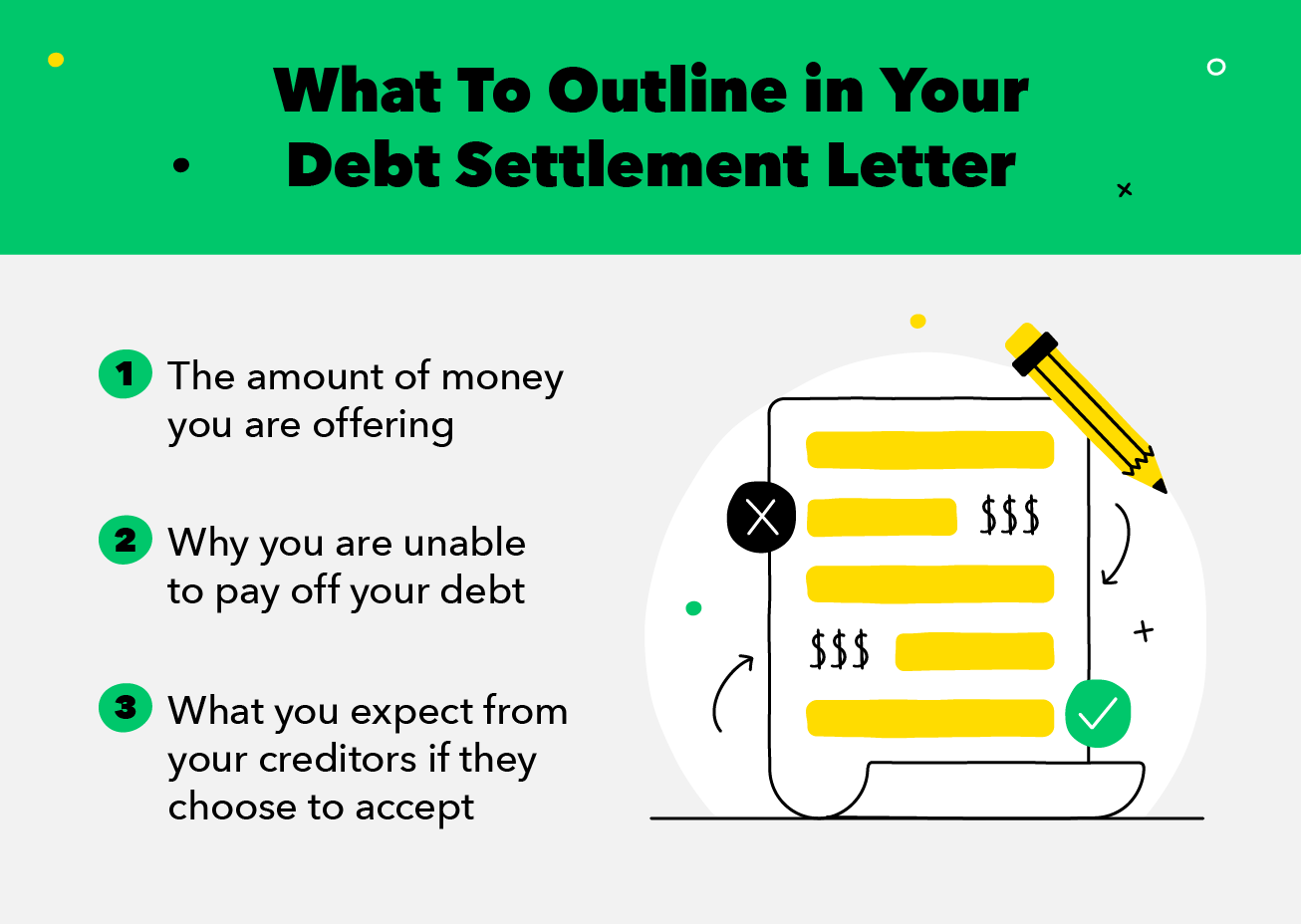

Negotiate your own settlement try negotiating settlements with credit card companies or other creditors on your own. For instance, if you owed $12,000, you might settle upon a total payment of $8,000. Search online and check with your state’s attorney general.

You can negotiate a settlement with a single creditor or collector. Do your research research the debt how much can you afford to put toward a settlement? Debt settlement companies typically charge in one of two ways.

The most common method is to negotiate a settlement with the credit card company. If you have decent credit, you can try to acquire a credit card which will consolidate all of your debt onto one card. Debt settlement negotiations work in two basic ways:

Do your homework on a debt relief service you are considering working with. A debt settlement company may charge fees totaling 15% to 25% of the settled amount. The typical debt in a suit brought by other major.

This means you agree to pay a certain amount of money in order to settle your debt. You should still come out. Once a lawsuit is filed, it creates a new opportunity for you to negotiate a settlement.

/HowtoNegotiateaCreditCardDebtSettlement-56ca6b385f9b5879cc4d2891.jpg)